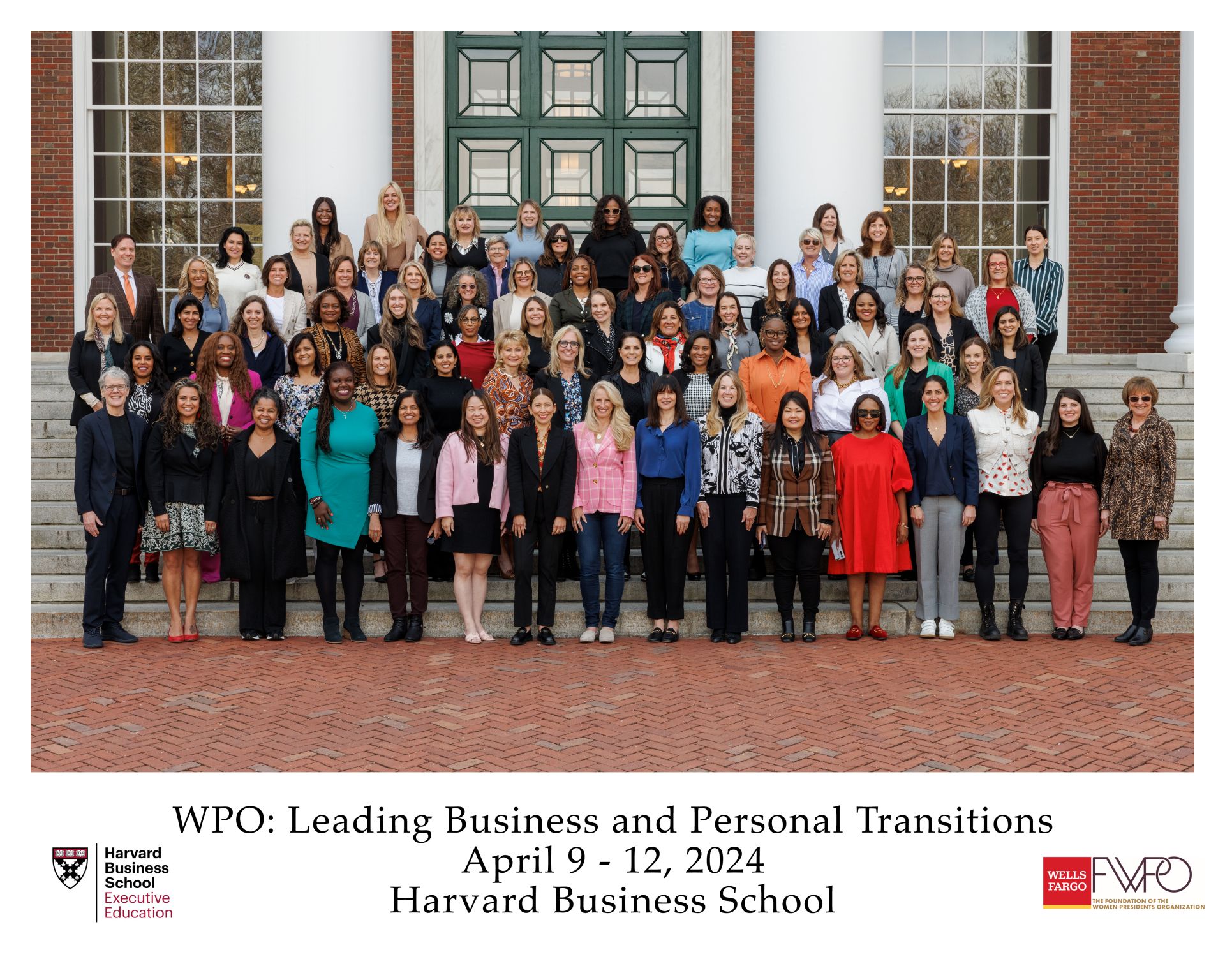

President Gisela Carere, MBA had the incredible opportunity to join 70 trailblazing women, from around the world, who were accepted into the Harvard Business School program: Leading Business and Personal Transitions.

The insights provided by academia were phenomenal, with valuable tools to leverage, both in business and personal growth. We are grateful to the Women Presidents Organization and Wells Fargo for sponsoring us, as we continue to carry on with curiosity and determination.

Perhaps the best way to describe this experience, as Professor Lynda Applegate so pointedly stated is: “Entrepreneurship is the relentless pursuit of opportunity without regard to resources currently controlled” Source: Stevenson H.

And so, she returns home excited to continue to learn and always think outside of the box.

READ MORE ON GISELA’S EXPERIENCE HERE

According to the Canadian Life and Health Insurance Association (CLHIA), benefits fraud costs insurers and plan sponsors millions of dollars each year, which can lead to increased premium costs.

- Joint Provider Fraud Investigation Program: A robust program that allows insurers to collaborate on fraud investigations that affect multiple insurers;

- Data Pooling Program: An initiative that pools data between insurers and uses advanced artificial intelligence to further identify and reduce benefits fraud; and

- Provider Alert Registry: A registry that allows insurers to view the results of other insurers’ anti-fraud investigations into specific practitioners.

- CLHIA’s free 15-minute Protect Your Benefits online course for plan administrators and their members

- CLHIA’s Fraud is Fraud program, including their FAQs on benefits fraud

- Our online guide to benefits abuse

- Tips for plan administrators and plan members to protect their plan

GET STARTED WITH US TODAY!